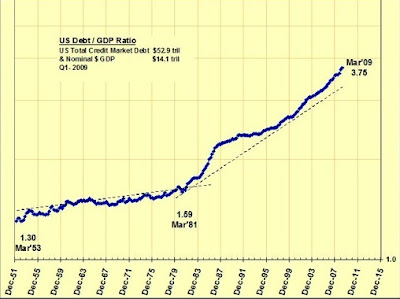

US debt/GDP ratio

Excess leverage was at the root of the current economic crisis. This chart shows that debt is still increasing because of huge government spendings. We have a long way to go back to more sustainable levels... Source: John Mauldin's newsletter