Sell in May and walk away

Let's have a look at the market saying that you should sell in may and walk away. Is there anything statistically true about it?

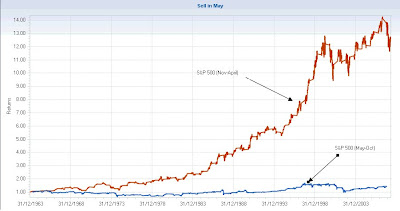

Well, you will be surprised by what I found. If you split the returns of the S&P500 into two semester, one from May to October and another one from November to April, you find out that most of the gains happened in the first part of the year.

Here is the strategy:

- Invest 1st May $X of S&P500

- Sell 31st October whatever your investment is worth: $Y of S&P 500

- Then reinvest 1st May of next year $Y.

...

This strategy would have returned 13 times your initial investment over 45 years.

when the same strategy between November and April would have returned only 1.5 times your initial investment over 45 years. It is less than the total progression of the S&P but considering that you would thus reduce your exposure and risk considerably (by half), it is very rewarding.

Well, you will be surprised by what I found. If you split the returns of the S&P500 into two semester, one from May to October and another one from November to April, you find out that most of the gains happened in the first part of the year.

Here is the strategy:

- Invest 1st May $X of S&P500

- Sell 31st October whatever your investment is worth: $Y of S&P 500

- Then reinvest 1st May of next year $Y.

...

This strategy would have returned 13 times your initial investment over 45 years.

when the same strategy between November and April would have returned only 1.5 times your initial investment over 45 years. It is less than the total progression of the S&P but considering that you would thus reduce your exposure and risk considerably (by half), it is very rewarding.