Stylized facts on financial frictions

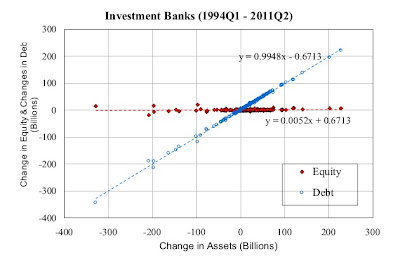

In a paper presented at the National Bureau of Economic Research (NBER) Macro Annual Conference (April 20-21, 2012), Adrian, Colla and Song Shin (2012) present four stylized facts about financial frictions: In a contraction, bank loans are reduced but bond financing increases to make up for most of the gap. For example, during the 2007-2009 crisis, the number of bank loans issued in the USA declined by 75% whereas the number of bonds increased by two fold. Credit spreads (= risk premium) increase in a contraction Bank lending changes dollar for dollar with a change in debt, with equity being "sticky". So, credit supply by banks is the consequence of their choice of leverage. (cf. figure 1 and 2) Bank leverage is procyclical figure 1: Investment Banks: change in equity and debt in relation to the change in assets figure 2: Commercial Banks: change in Equity and Debt in relation to a change in assets They then develop a model of financial intermediation that...