Stylized facts on financial frictions

In a paper presented at the National Bureau of Economic Research (NBER) Macro Annual Conference (April 20-21, 2012), Adrian, Colla and Song Shin (2012) present four stylized facts about financial frictions:

They then develop a model of financial intermediation that capture those stylized facts. Contrary to other models of financial frictions (Bernanke and Gertler (1989), Kiyotaki and Moore (1997), Carlstrom and Fuerst (1997)) firms still have access to appropriate credit in a downturn, but with this model, they are suffering from an increase in risk premium.

The next step would be to integrate this model into a general equilibrium model, so as to have a full macroeconomic model. The challenge would be to explain why banks leverage should be procyclical. The authors suggest that it could be related to the widespread use of Value at Risk as a measure of credit risk but this would need to be investigated further.

For more on the financial frictions, please refer to the article about my work.

- In a contraction, bank loans are reduced but bond financing increases to make up for most of the gap. For example, during the 2007-2009 crisis, the number of bank loans issued in the USA declined by 75% whereas the number of bonds increased by two fold.

- Credit spreads (= risk premium) increase in a contraction

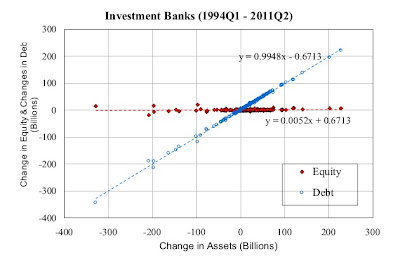

- Bank lending changes dollar for dollar with a change in debt, with equity being "sticky". So, credit supply by banks is the consequence of their choice of leverage. (cf. figure 1 and 2)

- Bank leverage is procyclical

|

| figure 1: Investment Banks: change in equity and debt in relation to the change in assets |

|

| figure 2: Commercial Banks: change in Equity and Debt in relation to a change in assets |

They then develop a model of financial intermediation that capture those stylized facts. Contrary to other models of financial frictions (Bernanke and Gertler (1989), Kiyotaki and Moore (1997), Carlstrom and Fuerst (1997)) firms still have access to appropriate credit in a downturn, but with this model, they are suffering from an increase in risk premium.

The next step would be to integrate this model into a general equilibrium model, so as to have a full macroeconomic model. The challenge would be to explain why banks leverage should be procyclical. The authors suggest that it could be related to the widespread use of Value at Risk as a measure of credit risk but this would need to be investigated further.

For more on the financial frictions, please refer to the article about my work.

Comments

Post a Comment